Internal Audit Organization and Operations

The internal audit organization and operations are conducted in accordance with the "Detailed Rules for the Implementation of Internal Audit" established by the company:

1. Purpose of Internal Audit

To assist the Board of Directors and management in inspecting and reviewing deficiencies in the internal control system, measuring the effectiveness and efficiency of operations, and providing timely recommendations for improvement. This ensures the continuous and effective implementation of the internal control system and serves as a basis for its review and revision.

2. Organizational Structure and Staffing

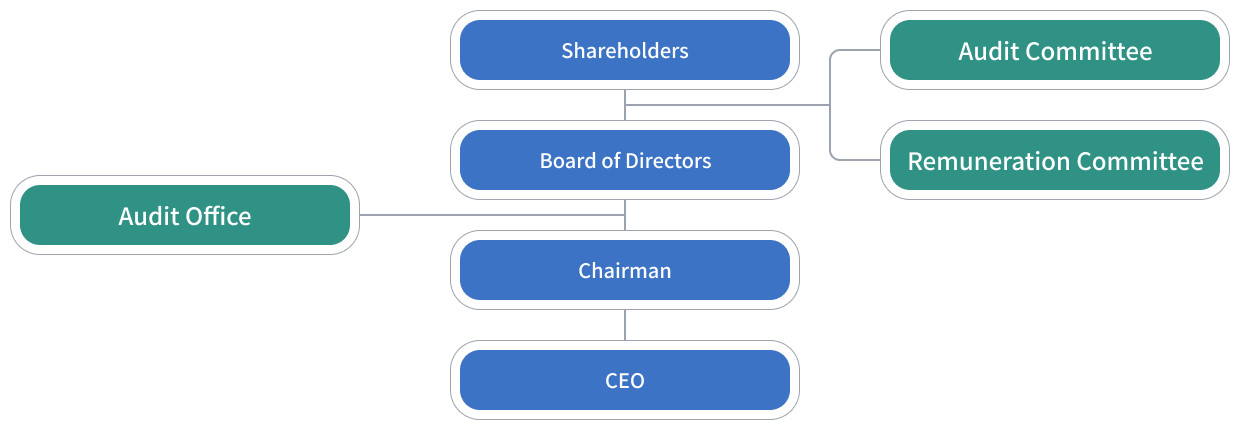

2.1. The Internal Audit Office is subordinate to the Board of Directors. It functions as an independent, dedicated unit performing regular and irregular financial and operational audits to assess the soundness, reasonableness, and effectiveness of the internal control system.

2.2. The company allocates a qualified and appropriate number of full-time internal auditors based on company scale, business conditions, management needs, and relevant laws. This includes one Chief Internal Auditor and several internal audit staff members.

2.3. The appointment or dismissal of the Chief Internal Auditor must be approved by the Board of Directors and reported via the internet information system for record-keeping by the 10th day of the month following board approval.

2.4. The appointment, dismissal, evaluation, and remuneration of internal audit personnel are signed off by the Chief Internal Auditor and submitted to the Chairman for final approval.

2.5. Internal auditors must meet statutory qualifications and attend continuing education programs organized by FSC-recognized institutions for the required number of hours to enhance audit quality and capability.

3. Internal Audit Operations

3.1. The primary duties involve investigating and evaluating the effectiveness of the internal control system, measuring operational efficiency, and assisting the Board and management in fulfilling their responsibilities.

3.2. An Annual Audit Plan is formulated based on risk assessment results. After being submitted to and approved by the Audit Committee and the Board of Directors, routine audits are executed, with special project audits performed as needed.

3.3. Internal auditors maintain an independent, objective, and impartial stance. Upon completion of audit items, audit reports are issued for review, and deficiencies are tracked for improvement. These reports are delivered to the Independent Directors for review by the end of the month following completion.

3.4. The Chief Internal Auditor reports audit operations regularly to the Audit Committee and attends Board of Directors meetings to deliver reports.

3.5. The office supervises the annual self-assessment of the internal control system by all departments and subsidiaries and reviews their reports to establish a self-monitoring mechanism.

3.6. Based on the results of self-assessments and the improvement status of internal control deficiencies discovered during audits, the office provides a basis for the Audit Committee, the Board, and the President to evaluate the overall effectiveness of the internal control system and issue the Internal Control System Statement.

3.7. In compliance with regulatory requirements, the following audit-related matters are declared and filed:

By end of December: The “Annual Audit Plan” for the following year.

By end of January: The “Roster of Chief Internal Auditor and Audit Personnel.”

By end of February: The “Execution Status of the Previous Year’s Annual Audit Plan.”

By end of March: The “Internal Control System Statement” for the previous year.

By end of May: The “Improvement Status of Internal Control System Deficiencies and Abnormalities” for the previous year.